July 1, 2017 Changes

Retirement plan

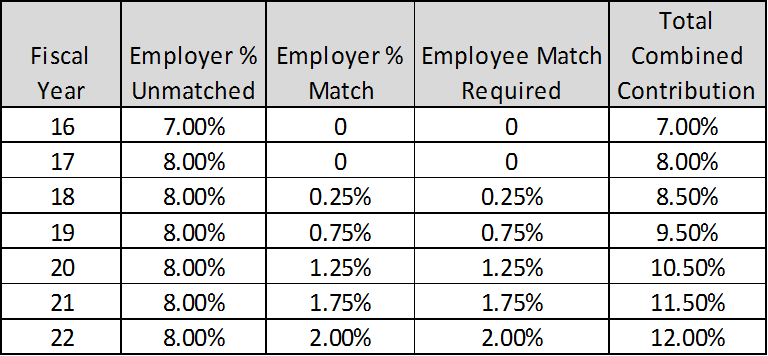

Dickinson has begun a phased approach to increasing retirement contributions, which started with all eligible employees receiving an additional 1 percent of salary contribution to their retirement on July 1, 2016. Effective July 1, 2017, Dickinson will implement an EMPLOYER retirement contribution match of .25% for eligible employees. If eligible employees contribute at least .25% of their own funds to retirement, employees will receive a .25% employer match from Dickinson.

Retirement contributions are planned to increase in subsequent years as shown in the chart below:

Dickinson’s retirement plan offers diversified investment choices through two platforms – Fidelity and TIAA. With the assistance of an independent investment consultant, we continue to evaluate and make changes to strengthen and streamline the investment options in the plan. Additional fund options are expected to become available in early fall.

Health benefits

Dickinson will invest $400,000 over four years to enhance the overall benefits package. The benefits subcommittee of the All-College Committee on Planning and Budget considered input from the campus community and financial considerations to subsidize and expand benefits as outlined below:

|

|

FY 17 |

FY 18 |

FY 19 |

FY 20 |

|

Vision |

Subsidize 50% of employee cost & 20% of cost for dependents. |

Same as previous year. |

Same as previous year. |

Same as previous year. |

|

Dental |

|

Subsidize 25% of employee cost & 10% of cost for dependents. |

Subsidize 50% of employee cost & 20% of cost for dependents. |

Same as previous year. |

|

Hearing Aids |

Increase benefit to $1,600 every 24 months. (Current benefit is $800 every 24 months.) |

Same as previous year. |

Same as previous year. |

Same as previous year. |

|

Autism |

Coverage for individuals with autism. |

Same as previous year. |

Same as previous year. |

Same as previous year. |

|

Infertility |

|

|

|

$8,000 lifetime maximum per contract. |

|

Transgender |

|

|

|

Transgender medical benefits and gender confirmation surgery at $75,000 cap. |

Dickinson continues to work toward the goal of reaching an overall employee cost-share average of 26% to Dickinson’s 74% by 2018-19. In the 2016-17 plan year, the overall average was 21.5% to Dickinson’s 78.5%. The increases will be implemented equally over the years. The college believes this is a sustainable plan that will allow Dickinson to invest in expanded benefits, increased retirement benefits and other key initiatives.

Insurance premium changed due to increase in market, increase in blended employee co-premium and implementation of "tilt".

Co-insurance percentage, deductibles and co-pays will not change this next year.

The salary bands and tiers within the structure will remain unchanged this year.

Health Care Flexible Spending Account

Dickinson will increase the 2017-2018 annual election amount from $2,550 to $2,600 to coincide with IRS regulations. Contributions should be planned carefully based on predictable medical, prescription drug, dental and vision expenses, because the Internal Revenue Service (IRS) requires that any money left unclaimed in your account at the end of the plan year's "grace period" (September 15) be forfeited.