Dickinson Student-Faculty Research at Forefront of Fight to Save Bees

Researchers use data and coding to better understand the effects of pesticides on pollinators.

Investing in Sustainability

Dickinson is investing resources to educate our students to be sustainability leaders and to make our campus a living laboratory for sustainable operations. The returns on this investment have been exponential, and include remarkable programmatic, financial, environmental, civic and reputational successes. Our sustainability commitment sets Dickinson apart from other liberal-arts colleges as a leader in sustainability education; helps us attract students, faculty and staff of high ability, aspiration and civic mindedness; provides exciting opportunities for alumni engagement, contributes to financial stability by reducing expenditures on energy and other resources; and, central to the college’s mission, enhances the educational experience of Dickinson students. The investment thus benefits our community and the wider world.

Dickinson’s endowment consists of approximately 900 individual funds either established by donors or designated by the board of trustees to be invested in the endowment (known as quasi-endowed funds). Endowed funds are managed to ensure the college carries out donors’ charitable intent in perpetuity by investing assets in a manner that is intended to produce results that exceed the amounts distributed for operational spending (plus inflation).

In 2006, Dickinson joined the Investure consortium, an outsourced chief investment office that serves the needs of a select group of prestigious nonprofit colleges and foundations. This relationship allows Dickinson to benefit from the capabilities and advantages of a larger investment office which would not be accessible to an endowment of our size. Investure manages over $18 billion in assets across all asset classes, including approximately 80% of Dickinson’s total endowment (the remaining 20% of Dickinson’s endowment is primarily held in third party trusts in accordance with donor agreements). Dickinson’s endowment pool has experienced exceptional returns as confirmed by annual higher education surveys, which regularly place the college in the top 10 percent of all reported long-term returns (as measured by average annual returns over a 10-year period).

In addition to the focus on sustainability within our endowment portfolio, the enhanced returns we have experienced from the endowment pool have allowed us to increase our direct investments in sustainability on campus and within our community. Annual spending from the endowment supports approximately 13-15% of the Dickinson operating budget and provides funding for other restricted funds as designated by donors. Spending from the endowment provides ongoing support for financial aid, academic programming, faculty salary support, facilities maintenance and a variety of other purposes.

Members of the Dickinson community have voiced concerns at various times about environmental, social and governance issues as they relate to the investment of Dickinson’s endowment, as well as investments that Dickinson makes in its students, faculty, staff, campus, and in the wider community. Examples include apartheid in South Africa, genocide in Darfur and the environmental effects of fossil energy. Dickinson has responded by convening cross-functional teams, consisting of faculty, staff and students, to examine the issues, share perspectives and seek agreement on actions that reflect the values of our community while meeting our fiduciary responsibilities. These included:

Investure has, and continues to be, a partner with Dickinson (inclusive of the Board of Trustees, Investment Committee and Dickinson committees and task forces) and other consortium clients in exploring the issue of sustainable investing and what it means within our combined portfolio. The Sustainability Efforts Timeline highlights key actions to date.

Investment Approach to Sustainability and ESG Investments

An important component of Dickinson’s Investment Policy is to maximize annual returns over a long-term period, which allows for a large allocation to equity-oriented strategies where the potential for long-term capital appreciation exists. In executing this strategy, Dickinson’s outsourced investment office, Investure, seeks to identify, understand, and weigh various factors that may impact the long-term risk and reward characteristics of an investment. ESG- and ethics-related considerations could have a material effect on the long-term performance and risk of any investment, no matter the industry. Investure’s due diligence process integrates considerations that frequently include ESG and sustainability as part of the investment underwriting process. In 2019, Investure dedicated a member of the Investment Team to focus full-time on sourcing, monitoring, and performing due diligence on ESG/sustainability investments to ensure that Investure is strategically considering how this area is evolving. This includes, importantly, monitoring and considering the impacts of long-term disruption, changes in supply/demand economics, and regulatory changes to the existing portfolio in the context of ESG/sustainability.

Another aspect of Investure’s current approach to incorporating ESG into the investment process involves asking third-party managers to consider voting proxies in accordance with certain Recommended Proxy Voting Principles. These principles are not mandatory directives but rather express explicitly the interest in ESG of Investure clients as long-term investors. This set of Recommended Proxy Voting Principles is sent to each manager at the time an initial investment has been closed.

Investure also offers clients the opportunity to make sustainable-specific investments. This enables Dickinson to increase the portfolio’s exposure to managers who are specifically incorporating sustainability into their investment process. These types of investments focus on environmental, social, and corporate governance as the central factors in measuring the sustainability and ethical impact of an investment with a strong emphasis on environmental factors.

Reporting

Investure provides Dickinson’s Investment Committee detailed semi-annual reporting on exposure to sustainability in the portfolio. This reporting involves evaluating the underlying assets that are held by each manager in the portfolio and categorizing those assets according to general definitions of “sustainability” as best as possible. This reporting also includes exposure analysis to investments with managers who have adopted formal ESG policies and the reporting is expected to continue to evolve to include relative reporting to appropriate benchmarks.

In early 2018, the Dickinson Sustainable Investment Group (DSIG) developed a Sustainable Investment Reporting Policy to guide Dickinson’s approach to reporting investments that promote sustainability. DSIG worked with Investure to further refine their approach to identifying sustainable investments in the portfolio. In particular, DSIG sought to include companies that have signed on to meaningful and impactful climate change initiatives, including efforts led by the Center for Climate and Energy Solutions, Ceres, the Task Force on Climate-Related Disclosures, RE100 and Science Based Targets Initiatives.

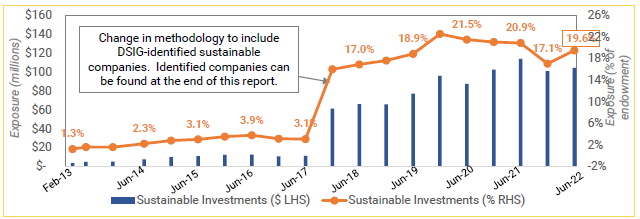

The following chart shows Dickinson’s exposure to sustainable investments in the pooled endowment since 2013. Sustainable investment exposure includes sustainable holdings within managers' investments as categorized by Investure as well as directly-held sustainable investments and DSIG-identified sustainable companies since 2018

Researchers use data and coding to better understand the effects of pesticides on pollinators.